Trying to find the right way to handle your student debt sometimes feels like trying to avoid talking about the presidential election. Everyone seems to have English porn moviesan opinion, so it’s easier to tune out and pretend it doesn’t exist. But your loans, like the election, won’t go away just because you want them to. So it’s important to know the details of your student debt.

We’ll help you get started by shedding light on four common student loan myths you might believe:

Public Service Loan Forgiveness isn’t the only way to get your federal loan debt wiped out. You can also get forgiveness if you sign up for one of the income-driven repayment plans, like Revised Pay As You Earn, which is available to all federal loan borrowers. For those plans, your monthly payment amount is tied to your income, and forgiveness applies to any debt you have left over at the end of your loan term. That’ll take 20 to 25 years, depending on which plan you sign up for.

If you qualify for both Public Service Loan Forgiveness, which forgives your debt after 10 years, and an income-driven repayment plan, you’ll save the most by opting for both. That’s because the income-driven plan will lower your monthly payment amount, so more debt can be forgiven after 10 years.

SEE ALSO: Why you shouldn't be spooked by student loansUse the Department of Education’s repayment estimator to see which income-driven plans you qualify for. You’ll have to reapply each year and, unless you go through the Public Service Loan Forgiveness program, you’ll have to pay income tax on any amount that’s forgiven.

Not necessarily. Debt that carries a higher interest rate than your student loans, like credit card debt or a personal loan, will leech money from your bank account faster than your student loans will. It’s best to tackle that debt first. But getting out of debt is just one part of financial security. You’ll also need to save for long- and short-term goals.

“An emergency fund and taking advantage of employer [retirement] matching contributions should almost always take precedence over paying off student loans,” says David Metzger, a certified financial planner at Onyx Wealth Management.

SEE ALSO: How a microloan helped my business growFigure out what you owe and what your interest rates are by logging into your various financial accounts. Then take a look at your monthly income and examine your spending habits from the past month. That way you’ll know which debts to pay off first, and you’ll be able to make room in your budget for both rent and retirement savings.

The truth is, it depends on when you took out your loans. Consolidation used to be a way to simplify your monthly payments, but recent grads usually have all of their federal loans with the same servicer, so it’s often no longer necessary.

Today, federal student loan consolidation is most useful in qualifying for Public Service Loan Forgiveness or income-driven repayment plans. That’s because Federal Family Education Loans, Stafford loans and PLUS loans need to be consolidated into a federal direct loan to qualify for those programs.

SEE ALSO: A 3-step plan for new grads with student debtBut if you have a Perkins loan and qualify for forgiveness, including it in consolidation would mean giving up forgiveness benefits for that loan. And if you have several different types of federal loans, it’s cheaper to exclude direct loans, since your new loan’s interest rate would be the average rate rounded up to the nearest 0.8%. Plus, your loan term will be extended if you owe more than $7,500, so you’ll end up paying even more over the life of your loan.

“If you are going to pursue an aggressive repayment of student loans, it would save you both time and money to repay the loans with the larger interest rates first, an option lost once you consolidate,” says Danna Jacobs, a certified financial planner at Legacy Care Wealth.

If you have student loans with interest rates over 6%, student loan refinancing could lower your interest rates and rein in long-term costs. It’s usually not a good idea to refinance federal loans through a private lender, though, since you’d have to give up federal borrower protections like income-driven repayment and forgiveness. To qualify for refinancing, you’ll need a steady source of income and a good credit score, typically 690 or higher.

Use NerdWallet’s student loan refinance calculator to see if it’s right for you.

Best iPhone deal: Save $147 on the iPhone 15 Pro Max

Best iPhone deal: Save $147 on the iPhone 15 Pro Max

'Quordle' today: See each 'Quordle' answer and hints for June 13

'Quordle' today: See each 'Quordle' answer and hints for June 13

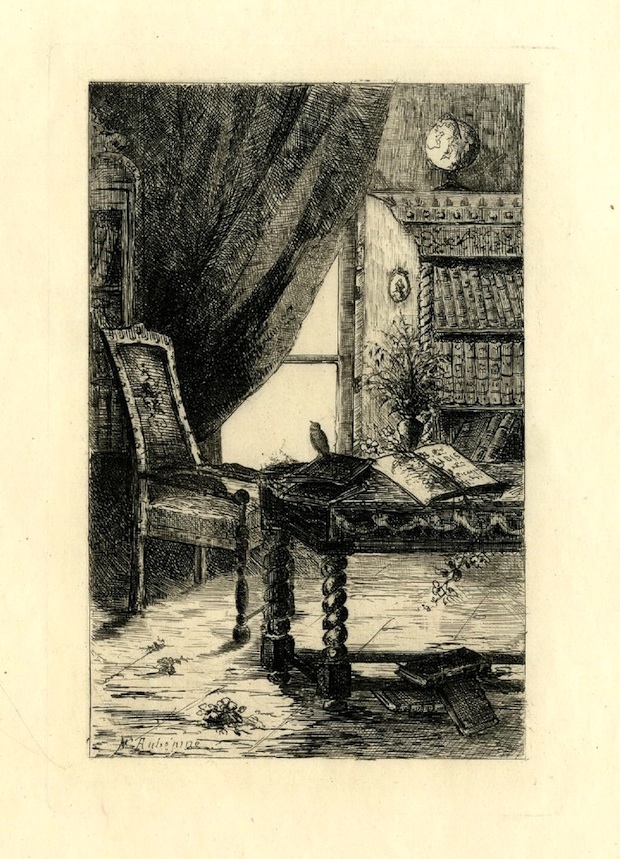

The Joys of Reading by Sadie Stein

The Joys of Reading by Sadie Stein

PA AG Josh Shapiro's son walks in on MSNBC interview in funny clip

PA AG Josh Shapiro's son walks in on MSNBC interview in funny clip

Elon Musk says Mars ship could make first flights in 2019

Elon Musk says Mars ship could make first flights in 2019

“I Always Start on 8 January” by Sadie Stein

“I Always Start on 8 January” by Sadie Stein

'Elemental' review: A fiery immigration narrative and a rom

'Elemental' review: A fiery immigration narrative and a rom

Bernie Sanders predicted Trump's election night chaos with terrifying precision

Bernie Sanders predicted Trump's election night chaos with terrifying precision

Revel Yell by Sadie Stein

Revel Yell by Sadie Stein

‘Jurassic World’: What was the headbutting dinosaur who saved the day?

‘Jurassic World’: What was the headbutting dinosaur who saved the day?

'Flamin' Hot review: Does it matter if a feel

'Flamin' Hot review: Does it matter if a feel

'Gleefreshing' is the opposite of doomscrolling

'Gleefreshing' is the opposite of doomscrolling

Contingencies by Lynne Tillman

Contingencies by Lynne Tillman

Sunday's Fat Bear Week match pits two fat favorites against each other

Sunday's Fat Bear Week match pits two fat favorites against each other

On the Occasion of her 151st by Sadie Stein

On the Occasion of her 151st by Sadie Stein

Why the big quake along San Andreas might not have shaken California yet

Why the big quake along San Andreas might not have shaken California yet

'Quordle' today: See each 'Quordle' answer and hints for June 11

'Quordle' today: See each 'Quordle' answer and hints for June 11

Amazon Big Spring Sale 2025: Save $20 on Amazon Echo Show 5

Amazon Big Spring Sale 2025: Save $20 on Amazon Echo Show 5

Wordle today: Here's the answer and hints for June 13

Wordle today: Here's the answer and hints for June 13

Harry Potter and the Deathly Hallows' 10Where’s Superman in that ‘Justice League’ trailer?Brad Pitt and Frank Ocean's friendship reached new heights at FYF FestivalBran Stark may have just revealed the ThreeGoogle Doodle celebrates the 'man who saw the internet coming''Doctor Who' Christmas finale: What we just learned about Capaldi's epic farewell10 'Game of Thrones' reality show spinoffs'Ghost Recon: Wildlands' PvP deathmatch mode coming later this yearYou can help NASA out during this summer's solar eclipse11 career moves for Sean Spicer now that all else has failedWhy Bitcoin is surging again, in plain EnglishWhere’s Superman in that ‘Justice League’ trailer?Marvel's 'Punisher' clip debuts at ComicWatch Gal Gadot's thunderous Hall H return at ComicNew 'Blade Runner 2049' clip plays at ComicNew 'Captain Marvel' details revealed at Comic11 career moves for Sean Spicer now that all else has failedHuawei unveils HarmonyOS 6 beta at HDC 2025 · TechNodeThe story of Sarahah, the app that's dominating the App StoreA flood of (bad) advertising is coming for your Snapchat—and that might be ok Elon Musk and The Rock bonded over these cursed Photoshopped memes Wordle today: Here's the answer, hints for October 5 Got a PS5 or Xbox Series X? Then you need a 4K TV with VRR to unlock their potential. Instagram and Facebook went down, so of course everyone made jokes on Twitter The FCC is cracking down on carriers that fail to address robocalls Watch these hardcore ducks binge on peas like there's no tomorrow How to watch 'Schitt's Creek' in 2022 Taylor Swift says turning off Instagram comments does wonders for self Instagram's thirst memes can open up healthy conversations about sex How the Targaryens and the Kardashians are entirely the same Parental controls are such a scam Rhaenyra straight up gaslights a continent to nab 'House of the Dragon' MVP YouTubers get around TikTok's copyright rules with bad cover songs People are editing photos of their cats into the Captain Marvel poster How to fix 'House of the Dragon' episode 7 from being too dark Donald Trump can't stop lying about the 'Tim Apple' flub for some strange reason TikTok will reportedly launch live shopping in the U.S. Elon Musk agrees to buy Twitter again ahead of trial 16 babydoll sheep so adorable you will cry Nobody showed up to the NYC AirPod Owners Meetup, and it only made the meme better

1.4645s , 8225.578125 kb

Copyright © 2025 Powered by 【English porn movies】,Charm Information Network